At least a Degree holder Employed for at least 1 month with a minimum salary of RM2500 Aged between 21 - 30 years old For those with less than 6 months of employment applications can still be considered if parents or siblings serve as guarantor. Depending on what the banks feel about your capacity to repay your car loan you may be required to nominate a guarantor to support your loan application.

The Malaysia Type Of Car Loan Proton April 2022 Tax Holiday Rebate Rm7000 Interest Rate As Low As 2 8

A guarantor acts as a third party offering security for the loan mainly through ownership of a property and a strong credit history.

. To apply for car loan you must have a salary of at least 3 times the monthly payment of the car. If not you still need a guarantor. All loans are still subject to final approval from banks.

Photocopy of passport. For an expat to apply for a loan they should make sure they have these documents. Procedure To Appy Loan To Buy A Car in Malaysia is a bit complicated.

Guarantor car finance is ideal for motorists who may otherwise struggle to be approved for a car loan. 35 x RM 70000 x 5 RM 12250. Almost anyone is capable of being a loan guarantor but there are some basic criteria that need to be met.

In Malaysia you are given a minimum of 1 year to a maximum of 9 years to pay off the loan. Guarantor has right to know the loan balance outstanding with the consent of the borrower. Individual lenders have their own criteria some set a minimum age of 21 and others need you to be a homeowner.

In Malaysia a guarantor may be required for a car loan especially if the borrower does not have stable income or have opted for a loan amount that goes above a predetermined percentage of his or her income. 23 Who is qualified to be the guarantor. You are eligible for an amount of up to RM 0 With a monthly payment of RM 0 You can afford a monthly payment of up to RM 0.

The deposit payment of any car purchase is usually 10 of the total car price. Problem assets over which security is difficult to grant. A guarantor is essentially the person who will be responsible for paying off the unpaid portion of your loan including all fees and interest charges that you have accumulated if you fail to honour the car loan agreement.

C An income earner at least an income of RM200000 monthly inclusive fixed allowance d Debt Service Ratio DSR not more than 75 22 How many guarantors are required for each application. The requirements are similar to those of a loan from an American institution. With a valid visa and a decent credit rating most expats are able to get loans from a Malaysian bank.

All loan amounts shown are indicative according to criteria provided by banks and do not constitute a guarantee of bank approval or loan amount obtainable. Monthly Interest RM 12250 5. GUARANTORS ELIGIBILITY CRITERIA 21 What are the criterias set.

Here is how your total interest monthly interest and monthly installment will be calculated based on the formula above. The QA gives a high level overview of the lending market forms of security over assets special purpose vehicles in secured lending quasi-security guarantees and loan agreements. Undergraduates Pursuing a degree in a recognised institution of higher learning.

Use a loan calculator. For example you will need to be at least 18 years old employed and you may need to earn over a certain amount. But when it comes to getting a car loan many do not fully understand how to calculate car loans and interests.

Simple application car loan with easy payment options low interest and a high maximum loan amount. To make it easier for you refer to your car seller about the Loan approval for hire purchace agreement and car registration. There is also a possibility of getting better rates if your guarantor has good borrowing credit history.

A guarantor is a person who agrees to pay off a loan on a borrowers behalf if the latter defaults on the said loan. Paycheck stubs from the previous 3 months. The bank only provide 90 loan unless you are a government staff and university graduated person.

As we mentioned in the beginning of the article chances of you becoming a guarantor without your consent is rather thin. You cannot become a guarantor unless you agree to it Be like Grumpy cat. These are the following.

You can check the latest plate number and choose your own. Loan calculators will help you determine how long it will take you to pay off the car loan. Maximum two 2 guarantors.

This may include young drivers who havent had time to build up a credit history. Guarantor must understand the type of loan and understand the obligation as a guarantor before signing the agreement. Read more Apply now.

It may also include those with poor credit scores and histories of missing payments and defaulting on loans. You must have Driving License Pay slip and Guarantor to get better interest rate for car loan in Malaysia. In Malaysia it would be extremely convenient to have your own car to move around.

This is because in most circumstances the guarantor will have to sign a document called a guarantee if he wants to take responsibility for the borrower. Lets circle back to the same example where your car loan is at RM70000 with an interest rate of 35 percent and a five-year loan period. But before we delve deeper into that here are some basic terms you should know.

6 Ways To Improve Your Credit Score While guarantor loans are a valuable way to help the borrowers there are some risks that you need to take into account. 18 years old or above Must not be in the state of bankruptcy Must have the mental ability to fully understand the guarantee document Must be willing to accept the conditions without peer pressure Some protections are given to guarantors. It is the overall cost of taking out a.

It covers creation and registration requirements for security interests. Its true that anyone can be a guarantor but a few legal requirements need to be met. A QA guide to finance in Malaysia.

Ensure that the agreement is not against the law. Risk areas for lenders. Get legal advisory on the implication of being a Guarantor.

Lenders will also examine other information about.

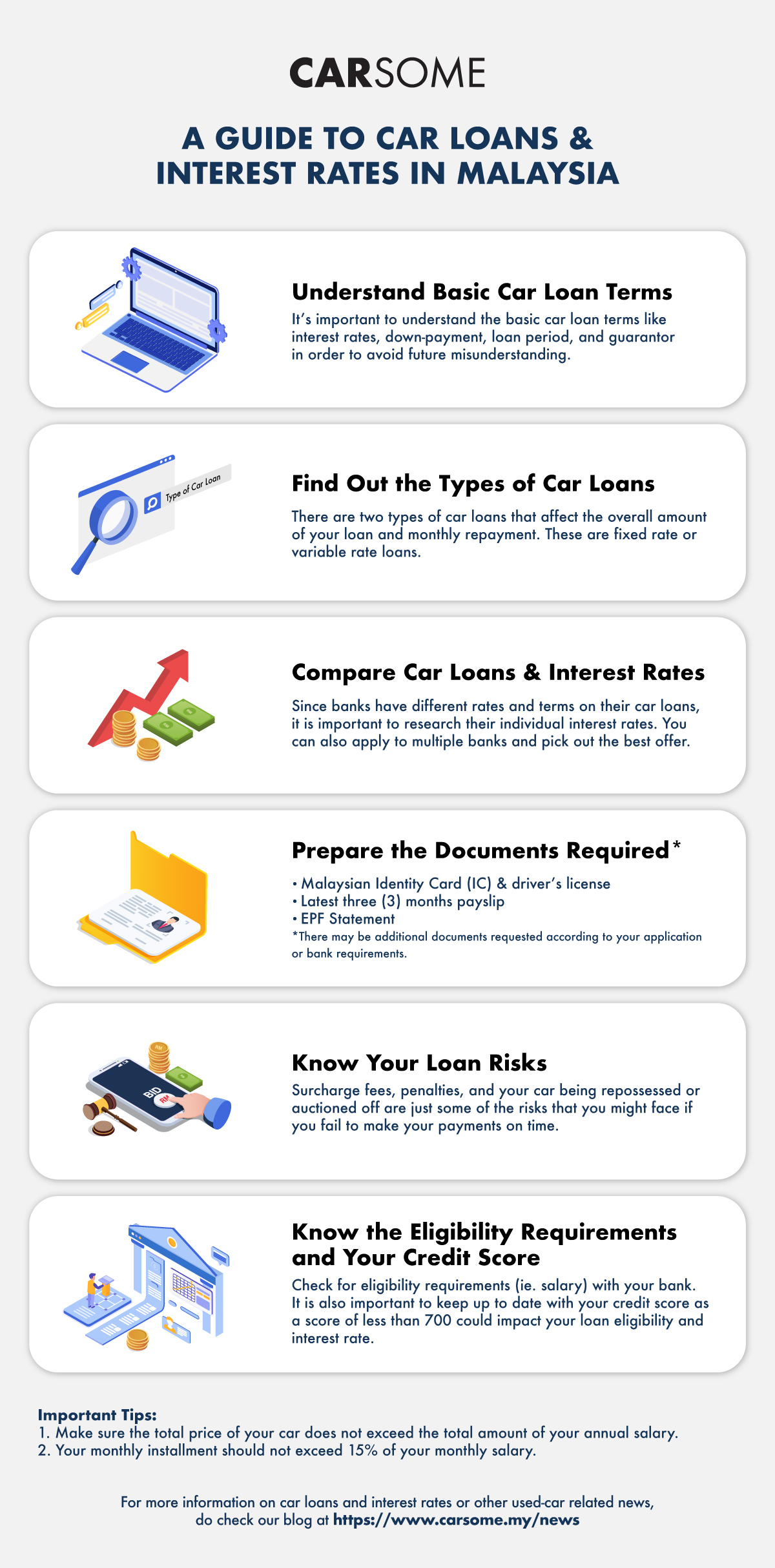

A Guide To Car Loans Interest Rates In Malaysia

5 Things You Should Know Before Getting A Car Loan Ezauto My

0 Comments